Companies and investors often use a ratio that compares SG&A expense with sales revenue as one way to measure a company's financial health.

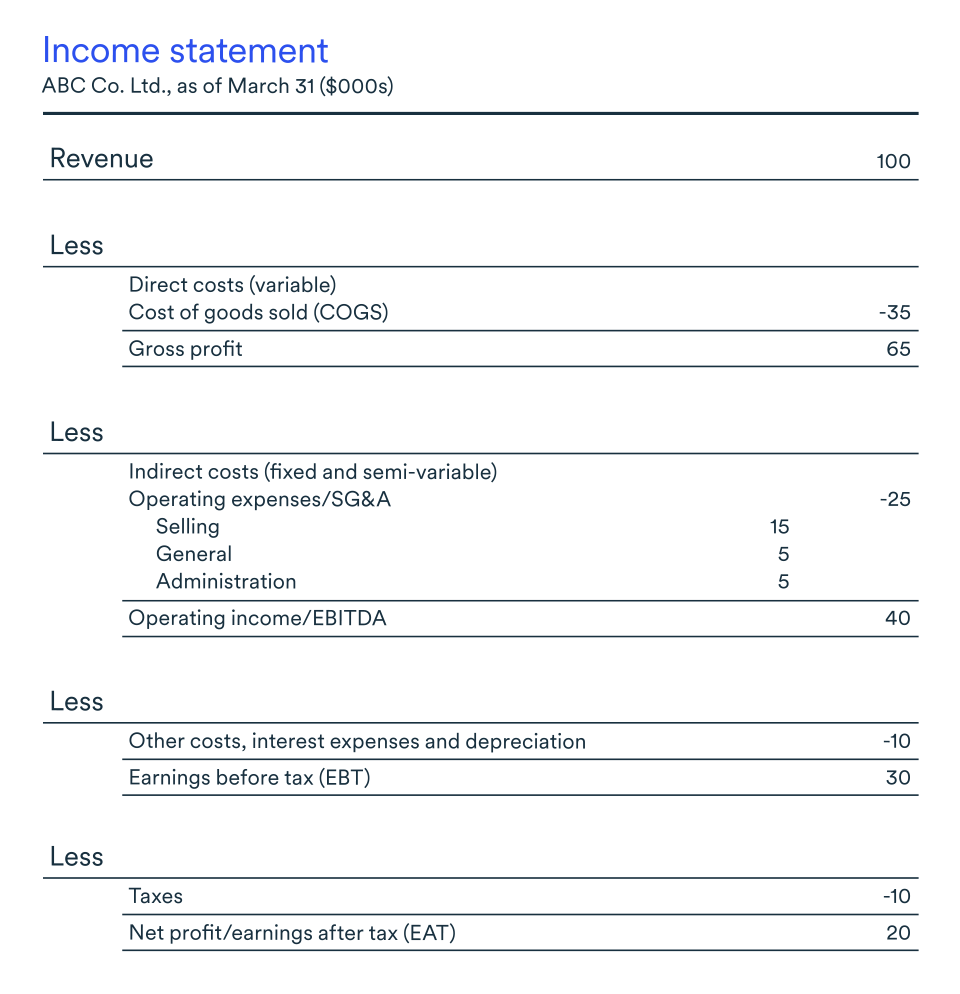

SG&A expense and its revenue ratio play a key role in explaining company profitability. Regardless of sales, a business needs to cover this mostly fixed overhead cost before it can begin to turn a profit, so understanding SG&A is important for management to understand. SG&A expenses are an important benchmark as to the company's break-even point. After all these expenses are deducted from revenue, profit or loss is what we call net income, quite literally, “the bottom line" on the income statement. SG&A expense is listed below gross profit, followed by other expenses that do not fall under SG&A or COGS, such as financial expenses which do not directly relate to central operations. This shows how much revenue remains to cover operating expenses and hopefully still leave a profit. On the income statement, total revenue is shown and reduced by COGS to arrive at gross profit. How does SG&A appear on the income statement? These expenses can also be referred to as overhead and include rent, utilities, insurance, salaries such as accounting and human resources, technology, and supplies other than those used in manufacturing. General and administrative expenses include most daily expenses that a business incurs in operations, whether it produces goods and generates revenue or not. Rather, these are expenses incurred throughout the manufacturing process to earn more sales, such as base salaries of salespeople, marketing, and out-of-pocket travel expense.

Other selling expense is indirectly related to the number of units sold. Unlike most SG&A expenses, these expenses are variable. For example, when a unit is sold, there may be packaging and shipping costs and sales commission payable to the salesperson.

These expenses may be direct or indirect.Ī direct selling expense occurs whenever a unit is sold. Selling expenses are the costs a business incurs in selling, distributing, or marketing a product. SG&A can be broken down into selling expenses and general and administrative expenses. Some of the most common expenses that do not fall under SG&A or COGS are interest and research and development (R&D) expenses. This includes salaries, rent, utilities, advertising, marketing, technology, and supplies not used in manufacturing. SG&A expenses include most expenses related to running a business outside of COGS. SG&A expenses are sometimes referred to as period costs since they relate to the time period in which they are incurred, and they do not relate directly to production. These costs are not related to specific products, so they are categorized separately from the cost of goods sold (COGS) on the income statement. SG&A includes most other costs related to running a business aside from COGS. COGS is the expense that most directly drives revenue and refers to the direct costs of manufacturing goods sold. The two main categories of expenses on an income statement are the cost of goods sold (COGS) and selling, general, and administrative (SG&A) expenses. Selling, general & administrative expenses (SG&A), also known as operating expenses, are the costs involved in daily business operations.

0 kommentar(er)

0 kommentar(er)